- What’s the Point of RWAs?

- Why are RWA’s Getting So Much Hype Lately?

- What is On-Chain Credit in Crypto?

- On-Chain Credit: Follow the Yield

- On-Chain Credit and Real-World Assets: Top RWA Companies

- The Risks of Real World Assets on the BlockchainL Not All Code is Gold

- Final Thoughts: Are RWAs in Crypto Legit?

The concept of a RWA is pretty simple– take something that exists in the real world and tokenize it on the blockchain.

That “something” could be a piece of real-world art, a Rolex, or a house. Heck, you can even tokenize a full business; in 2020, CoinCentral interviewed Stephane de Baets, the owner of the lavish St. Regis Aspen hotel, who was working on tokenizing his luxury resort, a fully functioning business.

What’s an RWA in simple terms? In a nutshell, the tokenizing of real-world assets (RWAs) makes fractional ownership possible– high-value assets can be broken down into thousands or millions of tokens, making them accessible to a wide variety of investors in a 24/7/365 (sometimes permissionless) marketplace.

Why you should care: Tokenized real-world assets are projected to grow to a $16 trillion market by 2030, projected to impact a litany of different people, like casual tech-savvy investors, real estate agents, art collectors, hedge funds, and more.

What’s the Point of RWAs?

Tokenization brings all the benefits that come with being a digital asset (fractionalization, 24/7/365 marketplace, and integration with smart contracts) to asset classes that have been historically limited in access.

For instance, consider the two scenarios:

- The “old school” way: A beautiful Victorian-style 5 bedroom, 4 bathroom home in the heart of Charlotte, North Carolina, is on sale for $850,000. Potential buyers include wealthy individuals, families, groups of real estate investors, hedge funds. Anyone with access to that sort of capital, likely obtained through a mortgage based on good credit, has a shot at making an offer and purchasing the house. This process could take months with tens of thousands of dollars going to back-office expenses and agent fees.

- The “RWA” way: The same house is tokenized on a tokenization platform– 10,000 tokens at $85 each. The smart contract defines contractual specifics and executes the sale and transfer of tokens without the need for additional human input. So, in addition to the list above, virtually anyone that meets the requirements of the tokenization platform (sometimes just KYC, AML, etc), can grab chunks of this mansion at $85 a piece at issuance, and re-sell in the future at whatever the market value of those tokens is.

There is much more to dive into the specifics of tokenized real estate, such as who gets to decide what is done with the property (renting, renovations, demolishment, etc), but that’s the gist of the value tokenization adds.

In addition to democratizing access to investment opportunities, tokenizing real-world assets:

- Improves capital efficiency: Shorter settlement times due to smart contracts and allowing asset holders to tokenize their assets and obtain loans from decentralized lenders (we’ll go into more detail below.)

- Saves on various operational costs: Smart contracts cut out much of the manual human servicing, filled with intermediaries and error. Various maintenance operations, such as coupon payment disbursements on corporate bonds, can be embedded into a token’s smart contract and carried out automatically.

- Enhances transparency and compliance: Smart contracts can be audited by third parties without extensive internal investigation. Compliance checks can be automated. The system’s 24/7 data availability makes reporting, immutable recordkeeping, and transparent accounting possible.

As we’ll explore in the next section, RWAs in Web3 have received considerable attention in the 2023 bear market.

Why are RWA’s Getting So Much Hype Lately?

RWA’s aren’t new; the tokenization of real-world assets has been happening since 2017.

This recent surge in attention has a dash of what McKinsey calls déjà vu, but both the many RWA-oriented companies and the underlying DeFi space are more established.

RWAs stand out in DeFi. While other sections have been losing Total Value Locked (TVL), RWAs have grown considerably during the 2023 bear market– tokens representing real-world assets have seen their TVL jump from $750M to over $6B in 2023.

Big brains like the Boston Consulting Group are predicting the RWA market could hit $10T by 2030.

Why?

Well, for starters, this ten trillion dollars of value isn’t popping up out of thin air– the value already exists, just in the real world. Tokenizing these assets just means putting their ownership on the blockchain.

Let’s take a look at one type of RWA– tokenized treasuries. What started as a relatively small market (tokenized U.S. treasuries, bonds, and cash equivalents), has grown nearly 6.6x in the past year, from $113M to $750M.

Surprisingly, the tokenized treasury spurt is led by a conservative traditional finance company, Franklin Templeton, which has tokenized over $300 million of its U.S. Government Money Fund.

The folks at Franklin Templeton don’t seem particularly interested in using crypto to come off as the old firm reinventing itself as a forward-thinking, techy, edgy company– they’re simply reaping the benefits of using the blockchain.

Why put a treasury on-chain?

Blockchain and smart contracts can automate and reduce lengthy back-office processes and operational costs, cutting out intermediaries, heaps of paperwork, and associated fees.

The most substantial value is in creating a 24/7 global marketplace for assets with immediate liquidity. Whether the RWA is a treasury or tokens tied to home equity, investors worldwide or those without the prerequisite brokerage account can buy and sell the assets from anywhere.

Treasuries are just a tiny blip on the radar of recent RWA momentum– let’s follow our nose to something called On-Chain Credit.

What is On-Chain Credit in Crypto?

“On-chain credit” refers to a category of protocols that offer crypto-based loans to borrowers that meet specific criteria, or are deemed to have “good enough credit” to borrow money without locking up their capital as collateral, as is common with more traditional DeFi protocols like MakeDAO.

The protocols created by companies like MapleFi, Centrifuge, and Goldfinch set credit ratings for each borrower. Instead of locking up their cryptocurrency to borrow cryptocurrency, borrowers collateralize their loans with off-chain assets and income.

Comparatively, other DeFi protocols like MakerDAO require borrowers to collateralize their crypto loans with crypto– meaning the digital assets they put up as collateral sit idle for the duration of the loan.

*record scratch*

Wait, so you’re telling me these crypto companies are basically just lending out to whoever they think will pay them back? Isn’t that what Celsius, Genesis, and Voyager were doing before they blew up?

Not exactly. That’s where real-world assets come into play. In most cases, credit-based loans will be secured by an asset– in this case, tokenized real-world assets.

Credit protocols sometimes offer “unsecured” lending opportunities, meaning no collateral is required.

Ideal borrowers are typically established institutions with real-world collateral to put up, and these on-chain credit protocols give them liquidity and somewhat favorable rates.

On the other side of the equation, lenders (typically only Accredited Investors, but sometimes only KYC/AML is required) can lend their funds in a pool and earn APY.

We’ll go over this in greater detail below.

On-Chain Credit: Follow the Yield

Let’s clarify a point before we go down this rabbit hole.

On-chain credit companies like Centrifuge, Maple Finance, and TrueFi are centralized companies running decentralized protocols– you deposit your crypto into a lending pool facilitated by smart contracts. “Pool delegates” are credible asset managers who launch and manage the pools, doing the “human” activities like running due diligence, underwriting borrower credit risk, and negotiating terms with creditworthy borrowers.

In contrast, companies like Celsius were centralized companies running centralized services– you deposited your crypto, they took full custody of it and did seemingly whatever they pleased with it. Lenders have only spoonfed information from Celsius directly, and CEO Alex Mashisnky claimed everything was fine until they froze funds.

This decentralization/centralization distinction shouldn’t be overlooked– but let’s not go down this rabbit hole just yet.

On-chain credit protocols tie themselves to real-world assets (“off-chain” assets). RWAs like the U.S. Treasury or real estate secure the loan amount, and the borrower uses the loan in a specific way deemed in the creditors’ best interest by the pool delegates.

So, for example, one could lend the DAI stablecoin in this “REIF Pool” on Centrifuge. Let’s stress the world EXAMPLE here: this is not investment advice.

This pool is to lend funds to REIF Financial Investments Inc. (REIF), an asset management company focused on acquiring commercial real estate assets. The loans are secured by physical real estate and will be used to finance commercial and construction projects.

Lenders would receive the advertised 5% APY for lending their DAI.

What happens if a company like REIF goes bust? Logic would assume that REIF’s real-world assets would be sold to make the lenders whole again.

The REIF lenders, however, own tokens representing real-world assets, which reflect the value of those assets determined by the market. What happens to the real-world assets is determined in bankruptcy court, where the collective creditors in the pool would likely have some priority claim.

On-chain credit protocols offer a wide range of asset categories, such as voluntary carbon offsets, payment advances, cargo & freight forwarding invoices, US Treasuries, gig economy payment advances, and more.

For example, the “Cash Management” offering on Maple Finance, is a pool secured by U.S. Treasury Bills.

Lenders deposit USDC for 4.73% APY; the pool specifies it’s designed “to meet the conservative risk profile and daily liquidity needs of DAOs, corporate treasuries, and fund managers.”

On-Chain Credit and Real-World Assets: Top RWA Companies

On-chain credit protocols are just one example of real-world assets being put to use on the blockchain.

Many companies have emerged in their respective fields, emulating the same model.

For example, the Goldfinch and Credix protocols collect USDC and lend it to businesses in emerging markets.

Franklin Templeton, Ondo Finance, and Matrixdock (mentioned above) hold 90% of the tokenized treasury market.

RealT is the market leader with a 50% market share for tokenized real estate, providing its customers with fractional real estate investment opportunities (try buying 1/1,000th of a house the old-school way) and various other options for home buyers and sellers. Other companies include Roofstock onChain.

Masterworks leads the art world in tokenizing fine art.

In the luxury realm, Arcade is tokenizing high-end watches.

There’s even a leader in tradeable cards– Courtyard leads the tokenizing of Pokemon cards.

The Risks of Real World Assets on the BlockchainL Not All Code is Gold

Tempering the RWA pep rally, tokenization comes with a few inherent risks in addition to its benefits.

For starters, the smart contracts must be immaculate. While human error is common and expensive, it’s possible to remedy some of its mistakes. Get a couple of people in a room and figure it out– who messed up, how do we fix it, how do we prevent it from happening again?

Smart contracts automate things and could magnify a mistake exponentially. For example, one of Parity Wallet’s developers accidentally permanently locked about $280 million of Ethereum in 2018– the mistake was as simple as accidentally deleting the code that grants access to thousands of Parity multi-signature wallets. In 2022, a flaw in NFT project Aku smart contracts locked $34 million.

And that’s just smart contract-related implosions. Some smart contracts can be exploited by hackers, siphoning millions of dollars of tokens.

And then, there’s user error. Instead of having a paper deed on file with the city and sitting in a fireproof safe at your Mom’s house, your asset ownership is purely digital. Crypto-savvy folks with exceptional digital security hygiene prefer the latter, but not everyone has excellent crypto custody know-how. Lost private keys are typically lost forever.

Shifting back to the RWA tokenization provider side, tokenization platforms have plenty of regulatory hoops to jump through. For example, the differences between tokens representing an RWA asset like a Rolex and those representing a fully functioning rental unit are significant– the latter likely being considered a security token, which comes with a new heap of complexity.

Final Thoughts: Are RWAs in Crypto Legit?

The concept of digital tokens tied to a real-world asset isn’t anything new or groundbreaking. The underlying technology is legitimate and has many live examples of working without issue.

The RWA subsector is worth following for educational purposes.

As far as investing your own money, that’s your call. We don’t do investment advice.

Here’s our non-advisory two cents: many are looking at RWAs as an avenue to earn yield– a Treasury can pay 5% APY whether it’s tokenized or not. High-yield savings accounts with FDIC insurance currently pay between 4% and 5.5%– no crypto knowledge or holding tokens necessary.

However, some RWAs offer access to opportunities outside the scope of the average person. For example, as of writing, there’s a Receivables Financing pool on MapleFi offering 14.14% APY; it specifies: “The strategy of the AQRU Real-World Receivables pool is to provide liquidity to US businesses by purchasing their receivables. The program focuses on tax credits provided by the U.S. Treasury, which are designed to encourage growth in targeted sectors of the economy. The pool accepts deposits above $50,000 USDC from accredited investors after completion of KYC.”

The $50k minimum and accreditation requirement aren’t exactly democratizing access, but they at least lower the barrier for something like receivable financing.

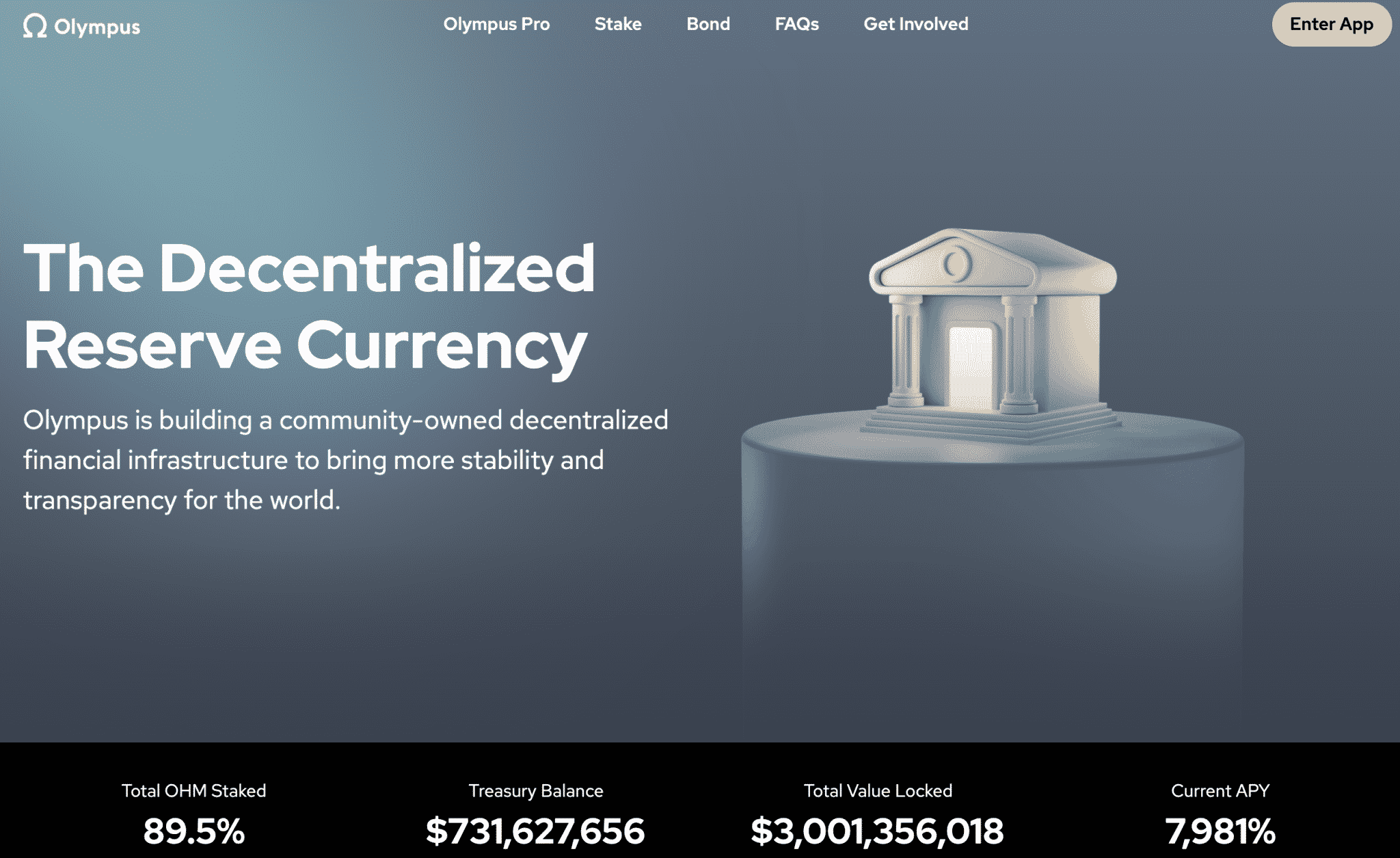

Let’s frame RWAs within the context of crypto history. RWA yield is much more conservative than 2020 “DeFi Summer” yields, ranging from Anchor offering 20% tied to a risky algorithmic stablecoin to Olympus DAO offering a 7,981% APY in its OHM token. Critically, the RWA lending and borrowing ecosystem is tied to actual assets instead of a made-up Internet token.

Most protocols listing RWAs are distinctly more conventional in their lending approach, requiring KYC & AML and often limiting pools to accredited investors. They also seem like a more direct avenue to work with regulators versus a decentralized protocol run by anonymous founders who only communicate through Twitter.

However, we implore our readers to heed the risks associated with all tokenized assets.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.